19

- December

2017

Comments Off on Thailand E-Tax

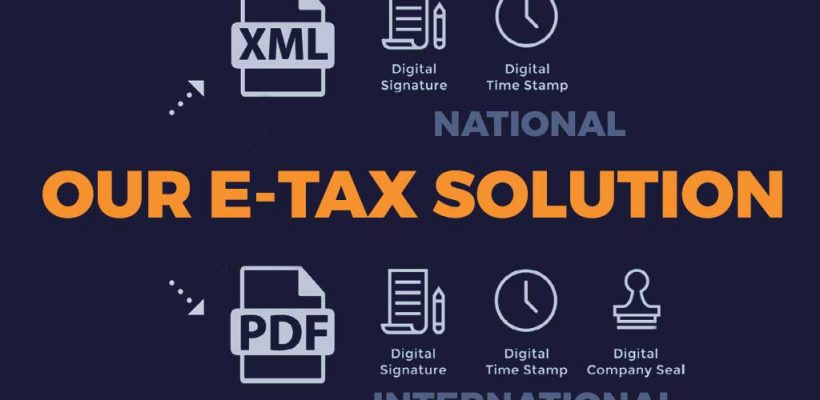

Thailand E-Tax

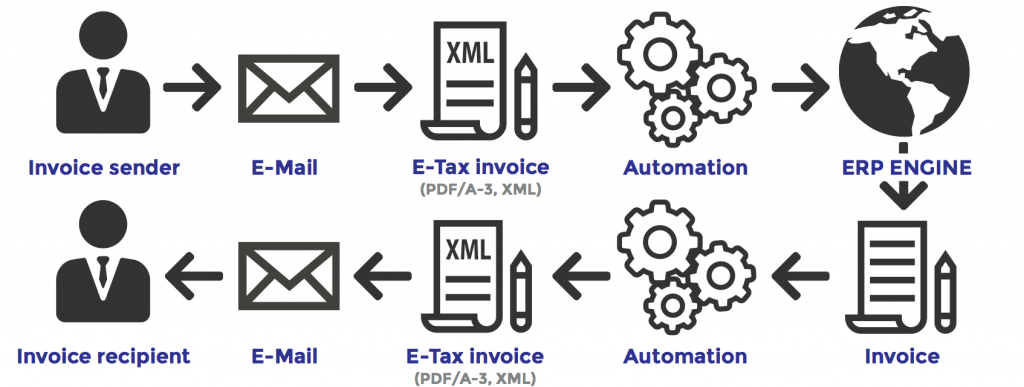

We are proud to be the authors of the official development guideline for the Thai E-Tax-Invoice released by ETDA.

Here we provide you with some example codes for how to use the Thai E-Tax invoice.

For your information: Using code examples to integrate into a commercial environment or tools such as

- Integrating E-Tax invoice code samples into ERP or invoicing solution, always requires valid licenses for iText and Inbatek components used.

- iText and Inbatek source codes are provided here under AGPL license

Therefore, developers and users are obligated to purchase commercial itext and Inbatek licenses in order to fulfill AGPL terms.

Examples

E-Tax invoice is only valid with a correct XMP record in the PDF metadata.

Here is an example how to extract the XMP metadata using iTextSharp 5.

This example shows how to produce a valid E-Tax invoice file